Description

GST Registration

The Goods and Services Tax (GST) is a tax imposed on goods and services consumed in India. It has replaced several other indirect taxes, including excise duty, VAT, and services tax. The GST Act, which became effective on July 1, 2017, was passed by the Indian Parliament on March 29, 2017.

Taxable Person under GST

A ‘taxable person’ under the GST Act is an individual or entity conducting business in India and registered or required to be registered under the GST Act. This includes individuals, Hindu Undivided Families (HUFs), companies, firms, Limited Liability Partnerships (LLPs), AOP/BOIs, government companies, foreign corporations, cooperative societies, local authorities, governments, trusts, and artificial juridical persons.

GST Registration Turnover Limit

GST registration can be obtained voluntarily by any entity, regardless of their turnover. However, it becomes mandatory if an entity’s turnover exceeds a certain threshold.

1. Service Providers: Individuals or entities providing services with an aggregate turnover exceeding Rs. 20 lakhs in a year are required to obtain GST registration. In special category states, the limit for service providers is set at Rs. 10 lakhs.

2. Goods Suppliers: As per notification No.10/2019, individuals or entities engaged exclusively in the supply of goods are required to obtain GST registration if their aggregate turnover crosses Rs. 40 lakhs in a year. To qualify for the Rs. 40 lakhs turnover limit, the supplier must meet specific conditions, such as not providing services, not making intra-state supplies in certain states, and not supplying certain products. If these conditions are not met, the supplier must obtain GST registration when the turnover reaches Rs. 20 lakhs (Rs. 10 lakhs in special category states).

Special Category States: Special category states under GST include Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, and Uttarakhand.

Aggregate Turnover: Aggregate turnover is calculated as follows: Aggregate turnover = (Taxable supplies + Exempt Supplies + Exports + Inter-State Supplies) – (Taxes + Value of Inward Supplies + Value of Supplies Taxable under Reverse Charge + Value of Non-Taxable Supplies). It is computed based on the Permanent Account Number (PAN), even if a person has multiple places of business.

Types of GST Registration

Various types of GST registration include regular, casual taxable persons, non-resident taxable persons, and eCommerce operators. Casual taxable persons, non-resident taxable persons, and eCommerce operators must obtain GST registration regardless of turnover.

1. Casual Taxable Persons: These are individuals or entities that occasionally supply goods or services in a state or union territory where they have no fixed place of business. This category includes those running temporary or seasonal businesses.

2. Non-resident Taxable Persons: Non-resident taxable persons (NRIs) are entities that supply goods or services in India but have no fixed place of business or residence in the country. This includes foreign individuals, businesses, or organizations.

3. eCommerce Operators: eCommerce operators are those who own, operate, or manage digital or electronic platforms for electronic commerce. Anyone selling through the internet is considered an eCommerce operator, requiring GST registration irrespective of business turnover.

What is GSTIN?

GSTIN, or Goods and Services Tax Identification Number, is a 15-character identification number provided to entities with GST registration. The first two digits represent the state code, while the following ten digits correspond to the PAN of the applicant.

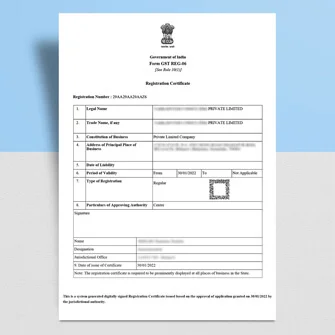

Download GST Registration Certificate

Entities with GST registration are required to prominently display their registration certificate at their place of business. The certificate can be downloaded through the GST Portal by logging in and navigating to User Services, then selecting View/Download Certificate.

Voluntary GST Registration

Entities wishing to supply goods or services can obtain GST registration voluntarily, regardless of their turnover. Voluntary registration can help businesses avail Input Tax Credit and issue GST bills to customers.

Penalty for NOT Obtaining GST Registration

Entities exceeding the aggregate turnover limit must obtain GST registration within 30 days. Failure to do so can result in a penalty of Rs. 10,000 and the loss of input tax credit during the period of delay.

Documents Required for GST Registration

The documents required for GST registration vary based on the type of entity:

– Sole Proprietor/Individual: PAN card, Aadhar card, photograph, bank account details, and address proof.

– LLP and Partnership Firms: PAN cards of all partners, partnership deed, photographs, address proof, Aadhar card, proof of appointment of authorized signatory, and bank account details.

– HUF: PAN card, Karta’s PAN card and Aadhar card, photograph, bank account details, and address proof.

– Company (Public and Private): PAN card, certificate of incorporation, Memorandum of Association/Articles of Association, PAN cards and address proof of directors, photographs, board resolution for authorized signatory, bank account details, and address proof of the principal place of business.

Benefits of GST Registration

Some advantages of GST registration include:

– Easier access to bank loans based on GST return data.

– Requirement for supplier onboarding with reputed companies.

– Necessary for selling online and through eCommerce platforms.

– Eligibility for input tax credit, allowing businesses to save on taxes.

– Improvement of business margins and formalization of business activity.

Maske Brothers can assist in obtaining your GST registration, making the process efficient and hassle-free.